Loan EMI Calculator

Loan EMI Calculator: An Essential Tool for Financial Planning

When you’re considering taking a loan, one of the most critical aspects to evaluate is the Equated Monthly Installment (EMI), which is the fixed payment you make every month towards repaying the loan. A Loan EMI Calculator is an easy-to-use online tool that helps you estimate the EMI amount, helping you better plan your finances. Whether it’s for a home loan, personal loan, or car loan, this tool simplifies the process of calculating the interest and principal amounts.

By simply inputting the loan amount, interest rate, and tenure, the Loan EMI Calculator instantly computes the monthly installment. It provides borrowers with a clear understanding of their financial obligations over the loan’s duration, ensuring informed decisions. This tool eliminates any guesswork and allows you to assess different loan scenarios effortlessly.

1. Loan EMI Calculator

In today’s time fast-paced world, managing finances effectively is crucial. One of the most important aspects of financial planning is understanding the concept of EMI, especially when applying for a loan. The Loan EMI Calculator acts as a powerful tool that empowers individuals by providing instant results on how much they would need to repay each month. This helps borrowers make better decisions about their loan options and repayment plans.

2. How Loan EMI Works

An Equated Monthly Installment (EMI) is a fixed payment amount made by a borrower to a lender at a specified date in every month. EMI is primarily made up of two components: Principal and Interest. The Principal is the amount borrowed, and the interest is the cost of borrowing that amount. Over time, as the borrower repays the loan, the principal decreases, but interest is calculated on the remaining principal. This is why, in the initial months, a larger portion of the EMI goes toward paying the interest, while later on, more of it pays off the principal.

3. Key Features of a Loan EMI Calculator

A good Loan EMI Calculator comes equipped with several key features that make it indispensable for loan applicants:

- User-friendly Interface: Easy to navigate, requiring basic details like loan amount, interest rate, and tenure.

- Speed and Accuracy: Provides instant and precise EMI values, allowing users to make quick comparisons.

- Versatility: Can calculate EMIs for different loan types such as home loans, personal loans, car loans, and more.

4. Benefits of Using a Loan EMI Calculator

Using a Loan EMI Calculator offers numerous benefits:

- Time-saving: It eliminates the need to manually calculate EMIs, saving valuable time.

- Accuracy: The tool ensures that your EMI calculations are free from human errors.

- Financial Planning: By knowing your EMI in advance, you can plan your monthly budget more effectively.

- Flexibility: It allows you to adjust loan amounts, tenure, or interest rates to see how each factor affects your EMI.

5. Types of Loan EMI Calculators

There are various types of Loan EMI Calculators available online, each designed for specific loan categories:

- Home Loan EMI Calculator

- Personal Loan EMI Calculator

- Car Loan EMI Calculator Each of these calculators takes into account the specific terms and conditions related to the type of loan, offering customized results.

6. How to Use a Loan EMI Calculator

Using a Loan EMI Calculator is incredibly simple:

- Enter the Loan Amount: The total amount you plan to borrow.

- Input the Interest Rate: The rate at which the loan is offered by the bank or financial institution.

- Choose the Loan Tenure: The duration over which the loan will be repaid, typically in months. Once these details are filled, the calculator will instantly provide the monthly EMI amount.

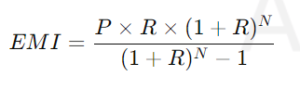

7. The Formula Behind Loan EMI Calculation

The EMI for a loan is calculated using the formula:

Where:

- P is the principal loan amount

- R is the monthly interest rate

- N is the number of monthly installments

This formula considers both the interest and the principal repayment to give the final EMI figure.

8. Factors Influencing EMI

Several factors can influence the EMI amount, including:

- Loan Amount: The higher the loan, the larger the EMI.

- Interest Rate: A higher interest rate increases the EMI.

- Loan Tenure: A longer tenure reduces the EMI but increases the total interest value paid.

9. Loan Tenure vs EMI

Loan period plays a important role in determining the EMI. A longer tenure means smaller monthly payments but increases the total interest burden over time. On the other hand, a shorter tenure results in higher EMIs but less overall interest.

10. Fixed vs Floating Interest Rate

Loans can come with either a fixed or floating interest rate:

- Fixed Interest Rate: Remains constant throughout the loan tenure, providing consistency in EMI payments.

- Floating Interest Rate: Changes with market conditions, causing the EMI to vary.

11. Prepayment and Its Effect on EMI

Making prepayments can significantly reduce your EMI burden. A prepayment is when you pay off a portion of your loan before the due date. This can either shorten the loan tenure or reduce the EMI amount for the remaining tenure.

12. Refinancing and EMI Reduction

Refinancing your loan at a lower interest rate can substantially reduce your EMI. Many borrowers choose this option to ease their financial burden, especially if market conditions lead to lower interest rates.

13. Mistakes to Avoid When Using a Loan EMI Calculator

Avoid these common mistakes when using a Loan EMI Calculator:

- Incorrect Inputs: Entering the wrong loan amount or interest rate can result in inaccurate EMI calculations.

- Overlooking Other Costs: Factors like processing fees, prepayment penalties, and late payment charges should also be considered when calculating EMI.

14. Frequently Asked Questions about Loan EMI Calculator

A. Loan EMI Calculator is used to estimate the monthly installment on loans based on the principal amount, interest rate, and tenure.

Yes, many online EMI calculators cater to various loan types such as home loans, personal loans, and car loans.

If you opt for a fixed interest rate, the EMI remains constant. For floating interest rates, the EMI may change as per market conditions.

Longer loan tenures result in lower EMIs but higher interest payments over the loan’s duration, while shorter tenures increase EMIs but reduce the total interest.

Yes, by making prepayments or refinancing at a lower interest rate, you can reduce your EMI.

Yes, most Loan EMI Calculators available online are free to use.

15. Conclusion: The Importance of Financial Planning

A Loan EMI Calculator is a powerful tool for financial planning, helping borrowers make informed decisions by understanding their monthly obligations. It eliminates uncertainties, allows for better budgeting, and provides insights into how different loan terms affect repayment.

100 percent Cotton Scrubs Australia affiliate marketing affiliate marketing guide Airmed scrubs Apple Fob Watch Australia school uniforms 2026 best cancer treatment in India Best medical schools in the world Best workwear supplier in australia perth wa 2025 Best workwear supplier in australia perth wa reviews Bisley Workwear Perth Cars under 10 lakhs Christmas scrubs content creation corporate uniforms Custom sports uniforms Australia Custom work uniforms Australia Custom workwear Perth Delhi top 10 university in india Digital Marketing Strategies early childhood education FIGS scrubs Fun scrubs Fun scrubs Perth government schemes for startups in India Hospitality Uniforms Australia Make Money Online Men best workwear supplier in australia perth wa Personal Growth Positive Mindset Safety workwear Perth Social Media Marketing Sports uniforms Perth Top 5 university in India Top 10 University in India for Engineering Top 10 university in india government Top 10 university in india private Top 10 university in World Totally workwear Women best workwear supplier in australia perth wa उत्तराखंड पर्यटन स्थल प्रमुख आकर्षण यात्रा गाइड हिमाचल प्रदेश

Leave a Reply